Our Story: The Tipping Point

How 4 banking executives came to the conclusion that the only way to fix banking technology is to start over.

The Same Foundation, Different Makeup

Every decade promised revolutionary change. Every decade just added another layer on top of 1960s infrastructure.

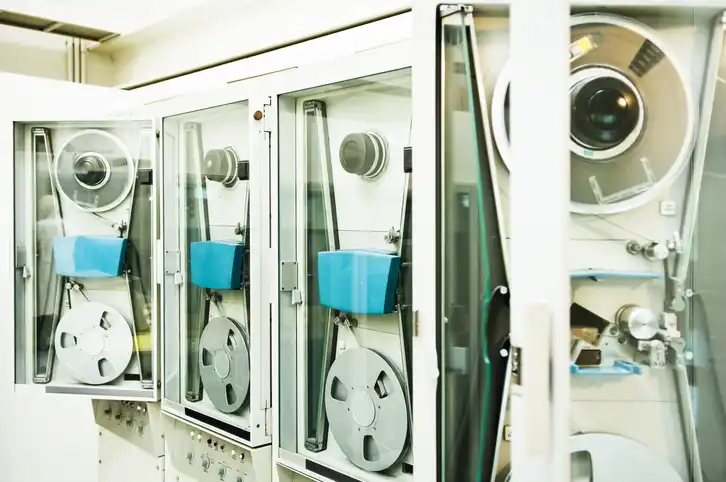

The Foundation

Magnetic stripe cards & mainframe systems

Banking technology was purpose-built for its time. Simple, centralized mainframe systems handled account management and batch processing efficiently.

First Digital Layer

SWIFT network & electronic transfers

Instead of rebuilding, banks added electronic payment networks on top of existing mainframe infrastructure. The foundation remained unchanged.

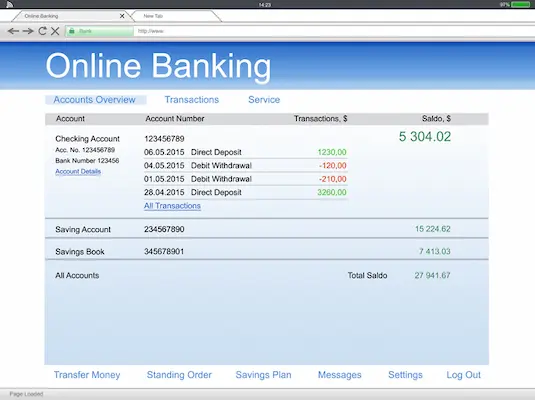

The GUI Facade

ATMs & early online banking

Graphical interfaces made banking look modern, but underneath, the same 60s batch-processing systems handled transactions overnight.

Internet Veneer

Web portals & online account access

Banks launched sleek websites, but they were just new front-ends connecting to the same mainframe infrastructure through middleware.

Mobile Makeup

Mobile apps & digital wallets

Beautiful mobile apps promised real-time banking, but most transactions still processed in overnight batches on decades-old systems.

Cloud Camouflage

APIs & fintech integrations

Cloud services and APIs created an illusion of modern architecture, but core banking still ran on mainframes with real-time facades.

AI Illusion

Machine learning & personalization

AI and ML promise intelligent banking, but they're analyzing data from systems that were designed when computers filled entire rooms.

Modern Foundation

Nucleus BankOS - Built for today

The first core banking platform designed from scratch for cloud-native, real-time, AI-powered banking. No facades. No legacy. Just modern.

The Pattern is Clear

For 55 years, every "revolutionary" advance in banking technology was just another layer of makeup on the same 1960s foundation. Mobile apps, APIs, AI—all beautiful facades hiding batch-processing mainframes.

Until now.

We've Seen Behind The Curtain

Banking Veterans

We're former banking executives who have seen what's really running behind those beautiful mobile apps and sleek interfaces.

New Foundation

We didn't add another layer. We built a completely new foundation designed for cloud-native, real-time, AI-powered banking.

Modern Control

Banks deserve a platform built for today's needs, not 60s infrastructure with modern makeup. One platform. Total control.

That's why we built Nucleus BankOSTM

The first core banking platform designed from scratch for modern banking. No facades. No legacy patches. Just a modern foundation built by banking veterans who got tired of the makeup job.